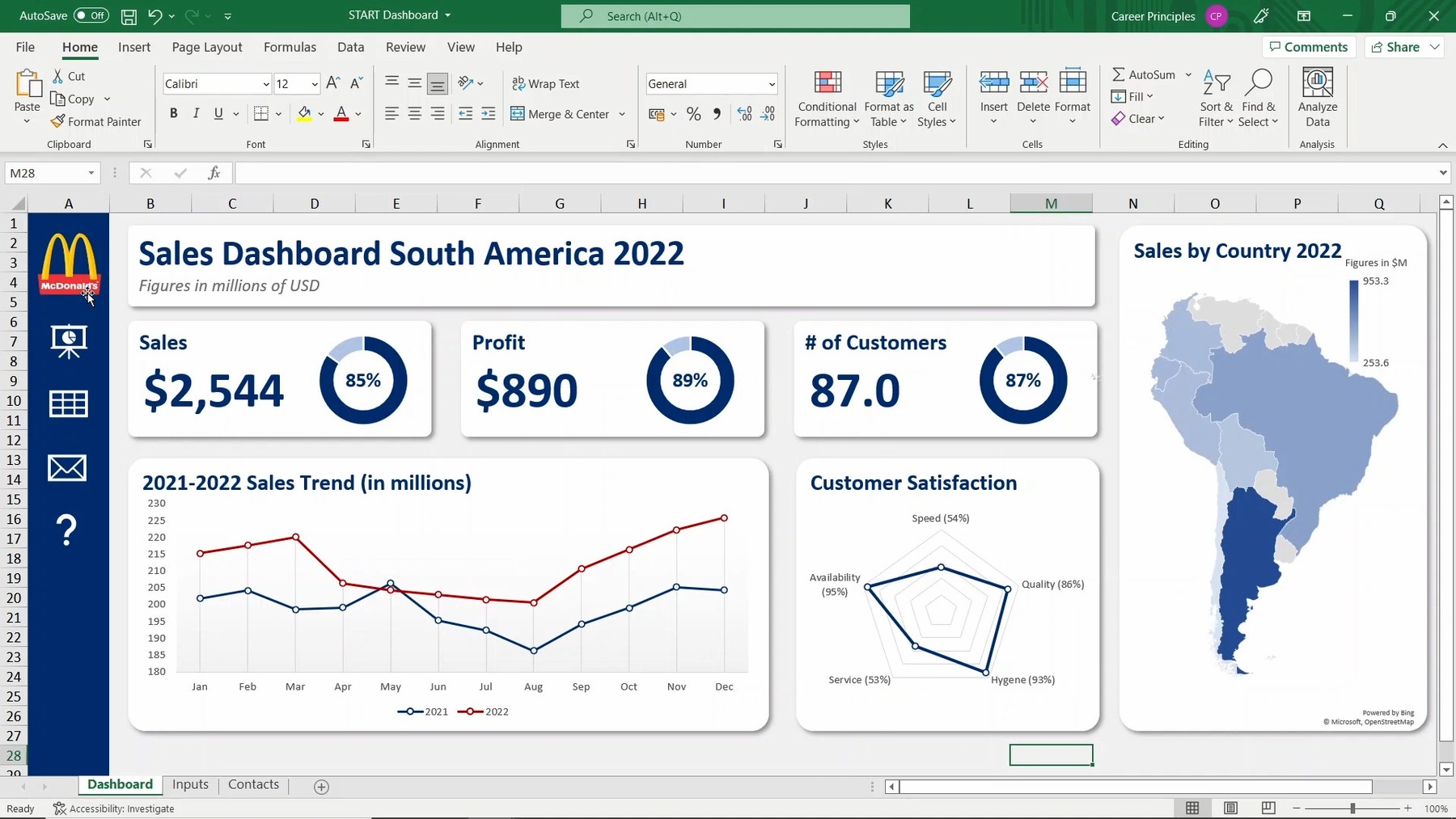

We take you step-by-step through the assumptions section of your model, focusing on the inputs and structure that will drive the revenue and cost of goods sold components of the income statement. At their core, all M&A, DCF, and LBO models depend on forecasts produced in the 3-statement model. This will typically be determined by the purpose of the 3-statement financial model.

Meet the instructor

Forecasting typically begins with a revenue forecast followed by the forecasting of various expenses. The net result is a forecast of the company’s income and earnings per share. Get instant access to video lessons taught by experienced investment bankers.

Start learning today

- Follow along with Chris Reilly, financial modeling expert and experienced Excel trainer, as he shows you how to build a three-statement model in Excel.

- With more time/information, we might also use metrics like the Days Sales Outstanding or Cash Conversion Cycle to forecast some of these items.

- If you don’t receive the email, be sure to check your spam folder before requesting the files again.

- Click here to learn how to build a sensitivity analysis into a 3-statement model.

You could attempt to input the data by copying and pasting from the PDFs, but it’s far more efficient to link directly to the Excel or CSV files. Before firing up Excel to begin building the model, analysts need to gather the relevant reports and disclosures. Your goal should be to finish the model, and if you can’t complete everything, simplify so that you can answer at least the main questions by the end. To avoid circular references, we can use watch excel for finance: building a three-statement operating model videos the Beginning Debt balance to calculate the interest expense as well (for more, see our tutorial on how to find circular reference in Excel). With these formulas, we can now add these links to the Cash Flow Statement and set the “Other” line item in Cash Flow from Financing to ~2% of Debt Issuances to represent the issuance fees. We would examine this point and refine these projections if we had several hours or days to complete this case study.

Further Learning

So, you must demonstrate Excel proficiency and the ability to interpret data and make reasonable assumptions. The video walkthrough below has captions for some of the Excel shortcuts, but it’s not a full Excel tutorial, and we assume you already know the basics. If you don’t receive the email, be sure to check your spam folder before requesting the files again. An integrated model is powerful because it enables the user to change an assumption in one part of the model to see how it impacts all other parts of the model consistently and accurately.

Statement Model, Part 3: Balance Sheet Projections

Understand what a financial operating model is and what attributes make for a good one. This video will follow the procedure outlined in the previous video titled Overview of the Process, but the model built will be far more thorough. If you improve over time and find it interesting to pick apart companies and business models, great.

For this exercise two years of historical financial data are provided to build the model. To complete this step you will need to link the information contained on these two worksheets to the template available on a separate worksheet. We walk through the process of building a 3 statement financial model starting with an empty Excel spreadsheet. Learn accounting, 3-statement modeling, valuation/DCF analysis, M&A and merger models, and LBOs and leveraged buyout models with 10+ global case studies.

Finalize your model by assembling a statement of cash flows to understand how cash is generated and consumed. A Simple Model exists to make the skill set required to build financial models more accessible. In real life, you do this to value companies, model transactions, and determine whether the company’s expected growth, margins, and cash flow metrics are plausible.

As these schedules are built the items shaded in purple can be appropriately linked to complete the model. Many financial models have to deal with a problem in Excel called circularity. A circularity in Excel occurs when one calculation either directly or indirectly depends on itself to arrive at an output.

A three-statement operating model incorporates your company’s income statement, balance sheet, and cash flow statement to provide an integrated and complete view of your organization’s financial health. Follow along with Chris Reilly, financial modeling expert and experienced Excel trainer, as he shows you how to build a three-statement model in Excel. Chris explains how to clean up source data, build the cash flow statement, build EBITDA, and forecast the income statement, balance sheet, debt schedule, and more. In this video you will learn to build a fully functional and dynamic three-statement financial model in Excel.